It’s October, and we all know what that means, right? No, we’re not talking about Halloween. It’s that time of year to use your dental insurance benefits before they roll over! Read on for some key tips for maximizing your dental benefits before the end of the year.

Dental Insurance Benefits Don’t Work Like Medical Insurance

Did you know dental insurance works differently than medical insurance? Most dental insurance isn’t actually insurance at all, but a benefit plan. They offer to pay a certain percentage of each treatment you may need, up to a limit. The limit is your total benefits per year, which you pay for with your monthly premium.

But here’s the catch: if you don’t use up the allowed benefits by the end of your coverage year? Poof. That’s right, under most dental benefit plans, your remaining benefits do not accrue into the following year. Your benefit resets and the insurance company keeps whatever went unused.

Many Health Savings Accounts work the same way. Basically, use it or lose it!

Maximizing Your Dental Insurance Benefits Is Good for More Than Just Your Wallet

While we want to help you get your money’s worth out of your dental benefit plan and your HSA, your health is far more important than your wallet. Timely treatment is key in maintaining your oral health. Timing makes all the difference when it comes to everything from fillings and crowns to regular cleanings and x-rays.

As we discussed previously, delaying your regular cleanings can allow gum disease and inflammation, which can affect your whole body. Staying on your regular cleaning schedule makes all the difference in keeping gum disease at bay, and it’s even more important for patients with periodontal disease.

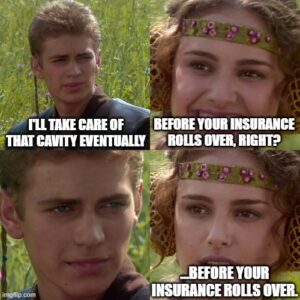

Did you know about 25% of Americans have untreated cavities? Are you one of those people? So many of us push off procedures like fillings and crowns for as long as we can. We completely understand. These procedures can be intimidating. What if it hurts? Can I afford to take time off to get this done? How much will it cost?

But as the end of the year approaches, we urge you to take the initiative to get the red marks off your chart. Cavities only get bigger the longer you wait. Cracks only get deeper. Unfortunately, these things generally don’t fix themselves. The longer you wait, the more invasive and expensive treatment will become. The best day to take care of this stuff is yesterday, but the second-best is today!

Check Out the Details of Your Dental Insurance Benefit Plan

Most plans roll over at the end of the year. However, your coverage year may have a different start date, so be sure to check!

Other things you should look at include:

- How often does your plan allow cleanings? Some plans cover two cleanings per year, but several will cover cleanings every 3 or 4 months. So take advantage if you can!

- Does your plan cover your regular x-rays? Most plans will cover your yearly check-up x-rays, and some even cover you for extras if you need them. We recommend once yearly for check-up imaging unless you have areas that need more attention.

- Does your plan cover fluoride treatment? Many plans cover patients under 16 or 19 years of age, but some cover you for life which is what we like to see!

- What amount do you have remaining for the year? It’s always good to know your benefit amount per year. If you’ve had a couple of fillings or cleanings already this year, check out how much you have left to use.

- What portion of each procedure does your plan cover? Just because you “have coverage” for things like cleanings, exams, fillings, crowns, and so on doesn’t mean your benefit plan will pay for 100% of any visit. While many plans will cover preventative care completely, many don’t. Unlike medical insurance, dental benefit plans are not required to cover preventatives at no cost to you. So be sure you know what to expect!

As always, we are here to help you navigate the ins and outs of dental care, including trying to get the most out of your dental benefits and HSA. As for that Health Savings Account, it’s also good to keep in mind that some will allow things like whitening services and electric toothbrushes. So like we said, use it or lose it! Call us today to find out how we can help make sure you get the most out of your plans, and keep smiling, Orlando!